By Jeffrey Dastin

AUSTIN (Reuters) -Months since ChatGPT’s debut, engineers and marketers at the stock exchange operator Nasdaq are embracing newer artificial intelligence, while its lawyers are treading more cautiously, its chief technology and chief information officer said on Tuesday.

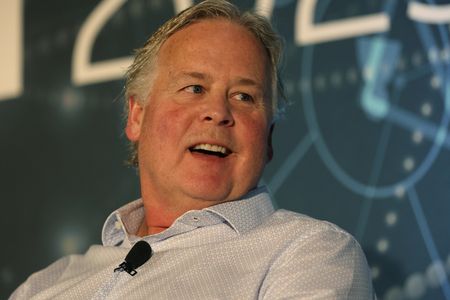

Inside Nasdaq, which also sells technology for global markets, workers across different departments are exploring how to use so-called generative AI, Brad Peterson said at the Reuters MOMENTUM conference in Austin. Like the viral chatbot, this technology can be prompted to produce text or other new content, based on past data.

One unit ran a “hackathon,” or collaborative engineering event, exploring how to imbue generative AI into its product for fighting financial crime, Peterson said, adding the technology could create investigative reports. The division, known as Verafin, has also embraced AI to address wire fraud and spot doctored checks.

“There’s going to be a race on the deepfakes,” Peterson said.

Computer programmers are looking to AI to suggest code for Nasdaq’s business, Peterson said. Marketers are exploring how ChatGPT-style programs can draft blogs.

On the other hand, lawyers at the company – a group that some more broadly expect to use AI to summarize long documents – are interested but to a lesser extent, he said.

“The legal team is a little more I would say cautious, naturally,” Peterson said.

Nasdaq has taken a permissioning approach to deal with concerns tied to AI, for instance, the risk confidential content fed to it could be accessed by others.

Employees must register to use certain AI tools internally and undertake training before they proceed, Peterson said. Engineers so far have filed more requests for permission than legal counsel have, a spokesperson added. The company would not immediately ban tools like others, though.

“We’re not going to go dark early,” Peterson said.

Still, despite using other forms of AI for years, Nasdaq’s latest work remains experimental; no code has been published yet drafted by AI, Peterson said. The company’s lawyers are hashing out with vendors who owns the final output, he said.

Nasdaq works primarily with Amazon Web Services, but not exclusively. On rival Microsoft, which is making a big business push through its investment in ChatGPT’s creator OpenAI, Peterson said: “We are absolutely a big user of the whole Office Suite and the corporate email and Teams” — products in which Microsoft is rolling out generative AI features.

Nasdaq has accessed a preview of Amazon’s answer to the generative AI race, namely Amazon Bedrock, a pick-your-preferred technology approach that includes Claude AI from the startup Anthropic. Peterson did not comment on Titan, the family of models Amazon itself created with less fanfare than OpenAI’s.

On the longer-term horizon for Nasdaq is integrating the Thoma Bravo-owned software firm Adenza, subject to closure of the $10.5 billion-deal Nasdaq announced last month. Adenza mostly uses on-premises data centers, meaning Nasdaq would have to help it with cloud migrations, he said.

(Reporting By Jeffrey Dastin in Austin; Editing by Kenneth Li and Deepa Babington)