By Howard Schneider

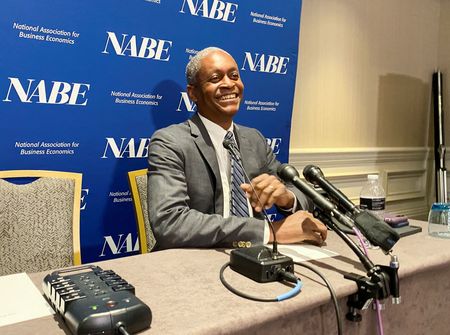

ATLANTA (Reuters) – There is no current “urgency” for the Federal Reserve to reduce U.S. interest rates given the strength of the economy and the need to be sure that inflation will return to the central bank’s 2% target, Atlanta Federal Reserve President Raphael Bostic said on Tuesday.

Inflation “is going to come down relatively slowly in the next six months, which means that there’s not going to be urgency for us to start to pull off of our restrictive stance,” Bostic said in comments to the Harvard Business School Club of Atlanta.

Bostic repeated that he expects two quarter-point rate cuts likely in the second half of the year, but emphasized that in the meantime inflation remains too high – and the Fed’s policy path depends on it continuing to slow.

“This economy is far stronger than I would have imagined it would be 12 months ago, and I’m really grateful for that,” Bostic said, citing an unemployment rate that has remained below 4% throughout the Fed’s ratcheting up interest rates by 5.25 percentage points to quell inflation.

Households and businesses “have been able to absorb a lot,” he said.

Bostic’s comments counter what is currently a strong conviction among investors that the Fed will cut the benchmark policy rate at its March meeting, a view given a more than two-thirds probability according to data compiled by the CMEGroup’s FedWatch.

“Inflation is still too high…So we have to continue to work to get inflation back down to that 2% level” targeted by the central bank, Bostic said. Inflation by the Fed’s preferred Personal Consumption Expenditures price index was 3% in October on an annual basis, though over short three and six month horizons it is only around 2.5%.

Timing the cuts will be important, he said.

The Fed’s benchmark rate will need to be lowered enough in advance of inflation returning to target that the economy can “coast into the 2%,” and not suffer an unnecessary blow in terms of rising unemployment, Bostic said.

“We got to be careful, because my goal is really to position our policy to minimize the amount of pain that folks have to go through,” while getting inflation back to target, Bostic said.

“That’s the strategy.”

(Reporting by Howard Schneider; Editing by David Gregorio)